The Government of Ontario has a broad set of policies and programs aimed at promoting electrification in the province. As a user of many of these programs I think a personal review might be of benefit to other users and the managers of the programs.

http://www.mto.gov.on.ca/english/vehicles/electric/index.shtml

Program Reviews

Electric Vehicle Incentive Program (EVIP) B

The EVIP is designed to subsidise the purchase of EVs, based on factors such as battery capacity and number of seats, the EVIP delivers an incentive of between $3000 and $14,000 depending on model. We qualified for the full $14,000 and this was processed by the dealer when we bought the car. The incentive brought the price of our car into a similar price range as a fossil car of the same make. By removing the premium for EVs, it allowed us to consider an EV when we would likely not have been able to afford one without the EVIP.

As a way of seeding the market and ensuring demand this program has been very successful. It has created long waiting lists for EVs in Ontario and has to be regarded as successful. This has highlighted a lack of effective supply side policy, but I will come back to this later.

My personal take on the incentive is I have been paid $14,000 to be an ambassador, I am happy to help promote EVs and share my experiences. But even if other beneficiaries of the program don’t share this view, just by being present on the road shows that EVs are now a normal choice of regular people.

The only thing standing between EVIP and an A are the delayed payments. The province did not have enough staff to process the payments quickly and there is a large backlog. Most dealers will not process the incentive on behalf of their customers due to long delays in getting paid. This means that the customer has to pay the $14,000 out of pocket and wait months for the cheque from the province, this reduces the affordability of EVs. I understand that more staff have been hired to process payments. Hopefully this will improve quickly.

Electric Vehicle Charging Incentive Program B+

This is a small program that provides a 50% incentive for both a home charger and the installation of the charger, up to $500 for each. This program is small in value compared to the EVIP but it has some great features that will help grow the EV market. Firstly the incentive is only available for chargers bought in Canada from a Canadian source. Without the incentive I would have saved some money and imported a charger from the US. With the incentive, I used a dealer in Ontario. The Canadian distributors and manufacturers are helped to grow and this will ensure that EV chargers are sold and supported in Canada. This is great choice by the province and means that you can go to Home Depot and pick up a charger just like any other appliance. The program also requires an electrical inspection ensuring that the charger is safely installed.

Once again, the only thing reducing my mark is the slow processing of payments, I have yet to receive my payment after 3 months.

Electric Vehicle Chargers Ontario (EVCO) D-

The EVCO grant program was intended to fund a large role out of Level 2 and Level 3 chargers with a completion date of March 2017. Funding of $19,845,122 is intended to deliver 274 Level 2 chargers and 211 Level 3 chargers. Level 2 chargers are slower chargers and are suitable for sites where users will spend 2-5 hours such as hotels, parking etc, Level 3 chargers are faster and suited to places where the stay is 40 minutes or less and along a travel corridor.

Without the EVCO program, long distance travel by EV (other than Tesla) would not be possible at all. The program has problems but these have to examined remembering that there were next to no level 3 chargers on the highways of Ontario before this program.

Missing Chargers

At seven months after the target date of the promised over a third of the chargers have not been delivered. Of the 274 promised Level 2 chargers, 50 are “coming soon”, with no plans for the final 42 and of the 211 Level 3 stations, 24 are “coming soon”, with the final 53 not planned .

I think this delay is understandable and forgivable, it is hard to plan a large project like at well over 200 sites, some delay is inevitable. Perhaps less understandable is that 42 Level 2 and 53 Level 3 chargers are not accounted for. It is unclear from the data available if these chargers are in process somewhere or if these are not going to happen.

Lack of Network Design

The design of the public network of level 3 chargers has favoured urban and suburban locations rather than the highway locations needed to enable long distance travel. There are significant gaps east and west of the GTA that are not yet filled. There are currently no plans for fast chargers at any of the 400 series highway service centres.

Low Power “Fast” Chargers

However, there are some more critical issues with the program. A large number of the Level 3 chargers that are intended to charge at 50 kW are restricted to much lower power. Koben Systems Inc (KSI) won over half of the available funding under the EVCO program with a promise of 152 level 2 chargers and 126 level 3. Many of KSI’s level 3 chargers are limited to 50 amps, outputting about 20 kW.

The time taken to make a trip longer than the range of an EV is highly dependant on the time it takes to charge. Using a charger rated at 50 kW, an EV will extend its range at about 250-280 kph. A charger limited to 20 kW will give about 110-130 kph. Driving 500 km beyond the range of an EV will take about 2 hours longer using restricted chargers compared with chargers operating at full power.

The chargers that are limited share their power feed with the host site and this causes a problem with Ontario’s demand pricing for electricity. Exceeding 50kW even once changes the class of an electrical service, increasing the overall cost of power significantly.

It appears that the vast majority of KSI stations are limited to 20 kW (50 amps) and as they are due to deliver 126 of the 211 the negative impact on the public charging network is extensive.

With so many of the chargers in the public network unable to deliver a truly fast charge, the prospects for long distance EV travel in Ontario are not good.

KSI also has severe support issues. Unlike any of the other charger network, the support line is not answered by someone able to do anything with the chargers. They promise that “support will call back” but it is unclear if they ever do.

The Province failed to provide clear specifications for the level 3 chargers and support processes and as a result we are left with a mess, fast chargers that are slow and non-existent support for the majority of the charging stations.

Cost of Charging

Currently, EV charging stations charge either based on time or a connection fee plus time. This model incentivises lowering the power of a fast charger to increase the time connected and the fees paid for a charge.

In my view, the fairest way to charge for level 3 charging is a small, fixed connection charge and then a per kWh rate that is published. EV charging stations need to be regulated in exactly the same way gas pumps are, from a consumer’s point of view there is no difference.

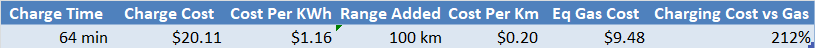

For KSI Level 3 chargers the combination of reduced power, their fee structure can push the cost of a charge to double the cost of gas for the same journey.

KSI fees at a power restricted Level 3 Charger

| Charge Time |

Charge Cost 1 |

Range Added |

Equivalent

Gas Cost 2 |

| 20 minutes |

$ 8.95 |

44 km |

$ 3.47 |

| 30 minutes |

$ 10.95 |

67 km |

$ 5.20 |

| 40 minutes |

$ 12.95 |

89 km |

$ 6.93 |

| 50 minutes |

$ 14.95 |

111 km |

$ 8.67 |

| 60 minutes |

$ 16.95 |

133 km |

$ 10.40 |

1 Charging cost based on KSI rates ($4.95 connection fee and $0.20 per minute) on a charger limited to 50 amps.

2 Gas cost based on $1.20 per litre and consumption of 6.5 l/100km.

Families with a conventional car in addition to an EV are far less likely to undertake long journeys in their EV if it costs them more and takes them a lot longer due to KSI’s chargers.

The EVCO charging network requires regulation and policy changes to move EV long distance travel from possible to the best alternative.

Quebec’s network of Level 3 chargers consistently delivers fast charging at a much lower price. A 30 minute charge will deliver 133 km and cost $6 on an Electric Circuit station, 64% cheaper and 100% faster than KSI delivers in Ontario.

EV Supply Management F

At this time, the Province is not attempting to manage the supply of EVs in Ontario. There a provision in the Electric Vehicle Incentive Program that each manufacturer must demonstrate a path to raise EV sales to 5% by 2020. However the only sanction is the loss of access to the EVIP, which, if you don’t plan to sell cars, is no sanction at all.

Today, EVs from Nissan, GM, Hyundai and Volkswagen are sold out until the middle of 2018, Tesla’s Model 3 first Canadian deliveries are not expected until late 2018. Finding a lower cost EV in Ontario is just about impossible. In 2018 I expect this to get much worse as Quebec has introduced a quota system for EVs that starts in 2018 at 3.5% of all car sales, rising to 15.5% by 2025. This quota has already removed the 2018 Ford Focus Electric from sale in the rest of Canada and it seems likely that Ontario will lose access to other models as the impact of Quebec’s quota system is felt.

As Quebec pushes forward there is a high likelihood that the shortage of EVs in Ontario will continue for many years, handicapping the Province’s EV programs. There is little point in stimulating demand, as Ontario has done so successfully if there are no cars to buy.

Federal Minister of Transport, Marc Garneau has not indicated any desire to move forward with a national EV quota system, it is left to the Provinces to address this as Quebec already has.

Overall Assessment D+

A Promising Start, Follow Through Lacking

The current programs have changed the landscape for the EV in Ontario. By making EV ownership easier and long distance EV travel possible, the Province is to be congratulated.

The lack of supply side policy has undermined these successes and in 2018 I expect to see the slow growth of EV sales to continue or perhaps fall back depending on how Nissan and Tesla address the Quebec market.

Urgent action is required to address the issues with EVCO and quotas if growth in EVs is to continue.

Views: 256